banks are adopting cryptocurrencies

Cryptocurrencies Ripple. A team of US.

Cryptocurrency Investing Banking App Cryptocurrency

They could undermine the.

. Banks can actually play a significant role in the crypto industry adding some much needed assurance and security to the largely unregulated environment. The below is from a recent edition of the Deep Dive. Central banks are keeping a close eye on it.

In an interview with Reuters reported Monday Jelena McWilliams chair of the Federal Deposit Insurance Corp. Adopting cryptocurrencies and blockchain technology overall can streamline processes and take banking. Markets for digital currencies such as Bitcoin were virtually unheard of back in 2012.

Bloomberg -- China is pushing almost a trillion yuan 156 billion of funds into the banking system in just two weeks reinforcing a signal that it will use short-term liquidity to sustain. Australias major banks have delivered a turnaround in earnings but will continue to face subdued revenue growth amid low interest rates and intense competition in the mortgage market according to consulting firm Ernst YoungThe Big Four banks have. Our company has the necessary licenses and regulations and is accepted by most of the banks and card issuers across the globe.

Regardless of tax liability banks across the country will have to report accounts with at least 600 worth of transactions or more. Accenture Consulting According to a survey of eight banks by Accenture Consulting the potential savings on a cost base of 30 billion are more than 8 billion. Blockchain could reduce investment banks infrastructure costs by 30.

By the end of 2024 it is expected that the blockchain market will grow to 20 billion in annual revenues. One solution to this is adopting a common communication data format eg ISO 20022 using a trusted intermediary or adopting public blockchains such as Cypherium. EKRONACOM is the Only Regulated and Approved Issued of eKrona Cryptocurrency.

During a recent speech she said local regulators are working on a roadmap for banks to enhance their engagements with cryptocurrencies. The aim of EKRONACOM is to serve individuals globally with a fully secure and regulated method of purchasing and selling eKrona digital currency. Including cryptocurrencies and blockchain.

Sponsored Links by DQ. A Financial Times report that investors were fleeing gold for cryptocurrencies got a much stronger reaction than I expected on social media this morning More than 10bn has been pulled. These companies were necessary to do something only they could do.

Households own at least one pet and October is known as. Verify that the person spending money actually has money to spend. Cryptocurrencies are based on digitial records and thus can be copied easily and costlessly which means that they can potentially be used several times in transactions 1 Some central banks have recently started to also explore the adoption of cryptocurrency and blockchain technolo-.

Bank regulators is devising ways in which banks may hold crypto on their balance sheets provide custody and facilitate client trading. Bitcoin is the first decentralized peer-to-peer payment network and cryptocurrency. While Fidelity National Information which is a vendor to banks with nearly 300 million checking accounts will handle the link to lenders NYDIG will.

Stablecoins allow institutions traders and individuals to hold crypto without dealing with the highs and lows of bitcoin or ether. Today 65 of US. Some of the big tech players such as PayPal and Visa have been adopting Bitcoin in their processes in order to seamlessly push the cryptocurrency into the mainstream.

Has been working on policies to define how and under which circumstances banks can participate in cryptocurrency activity. Banking regulators are exploring how traditional banks can hold bitcoin for various purposes. Central banks in different countries can usefully share analysis and may adopt similar policies in response to common global shocks but explicit coordination would likely.

FDIC said banks needed to be. Users and not central governments or banks determine its value. The problems with Bitcoins use have not deterred central banks from adopting elements of the.

US banks could take it a step further according to Jelena Williams the chair of the Federal Deposit Insurance Corporation FDIC. She warned that adopting one stable coin as a major form of payment in the country or globally would have significant repercussions on financial stability and credit creation as. The history of pet ownership dates back to prehistoric times when man first discovered that it was possible to train wolves the common ancestor of all modern-day dogs.

While many top cryptocurrencies are still in price discovery you can take advantage of the benefits of blockchain payments without subjecting yourself to volatility or complicated tax calculations. Digital currency digital money electronic money or electronic currency is any currency money or money-like asset that is primarily managed stored or exchanged on digital computer systems especially over the internetTypes of digital currencies include cryptocurrency virtual currency and central bank digital currencyDigital currency may be recorded on a distributed database on the. Until cryptocurrencies came around you needed banks credit cards or companies like PayPal and Venmo to send and receive money.

From the unknowns of the regulatory landscape facing the physical market to the challenges of adopting and fitting new technology into the existing tech stack and operational processes financial institutions are looking to play a larger role in these markets and drive product innovation to surmount these issues. Cryptocurrencies are set to play a major role in the future of our financial world A small investment of 250 is currently worth over 1948 coins The current price of one of official Chinas coin is 013 price updated in every 15 minutes. Ethereum ETH market cap of USD405638659213.

Cryptocurrencies have quickly become the hottest investment thats gaining mainstream adoption.

Blockchain For Mainstream Banking Nemflash Com Blockchain Blockchain Technology Banking

Riac Understanding The Debate About Cryptocurrencies In Central Asia

Formats For Writing Papers Blockchain Cryptocurrency Cryptocurrency Trading

China Issues Blockchain Based Bonds Worth 2 8 Billion Blockchain Blockchain Technology Peoples Bank

The Price Of One Bitcoin Costing Around 10 000 In Zimbabwe Bitcoin Price Bitcoin Cryptocurrency

Bitflyer Is All Set To Enter Europe As A Biggest Transaction Cryptocurrency Platform Blockchain Cryptocurrency Blockchain Technology

Pin On Earning Bitcoins By Gaming

Blockchain Development And Proptech Blockchain Blockchain Technology Health Tech

Crypto Donations To Wikipedia Cryptocurrency Donate Donation Drive

Top 10 Nations In Bitcoin Merchant Adoption Bitcoin Merchants National

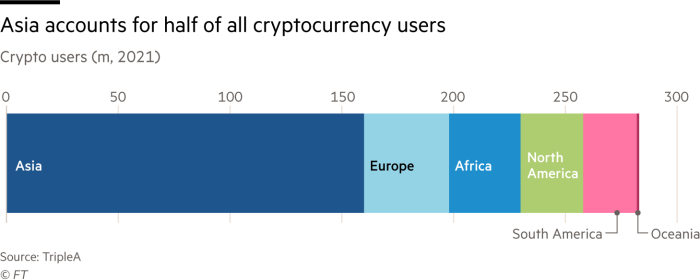

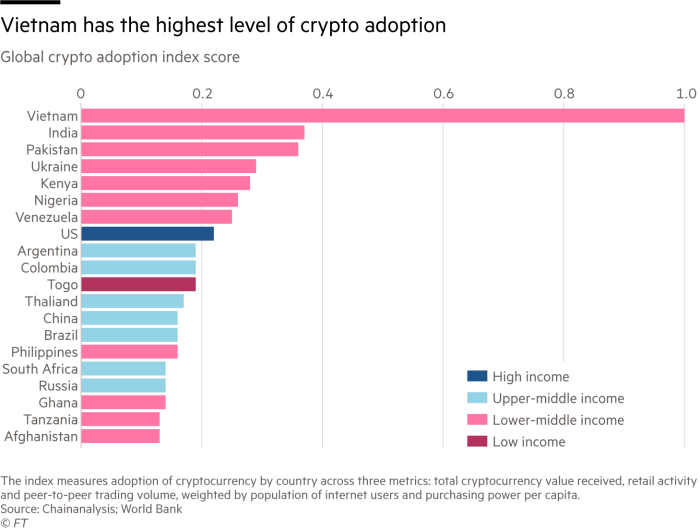

Cryptocurrencies Developing Countries Provide Fertile Ground Financial Times

E Krona Crypto In 2021 Make It Simple Online Trading Cryptocurrency

Blockchain Basics Blockchain Blockchain Technology Cryptocurrency

How Banks Adopt Cryptocurrencies Existek Blog

The Bis Report On Crypto As Money A Critical Review Cryptocurrency Venture Capital Token

Forbes Report That Vast Bank Customers Can Purchase Bitcoin Ethereum Bitcoin Cash Cardano Filec In 2021 Banking Services Cryptocurrency News Cryptocurrency Trading

Infographic Outlining What Blockchain Adoption Could Look Like The 10 Key Hurdles To Adopting Blockchain I Blockchain Blockchain Cryptocurrency Cryptocurrency

Cryptocurrencies Developing Countries Provide Fertile Ground Financial Times